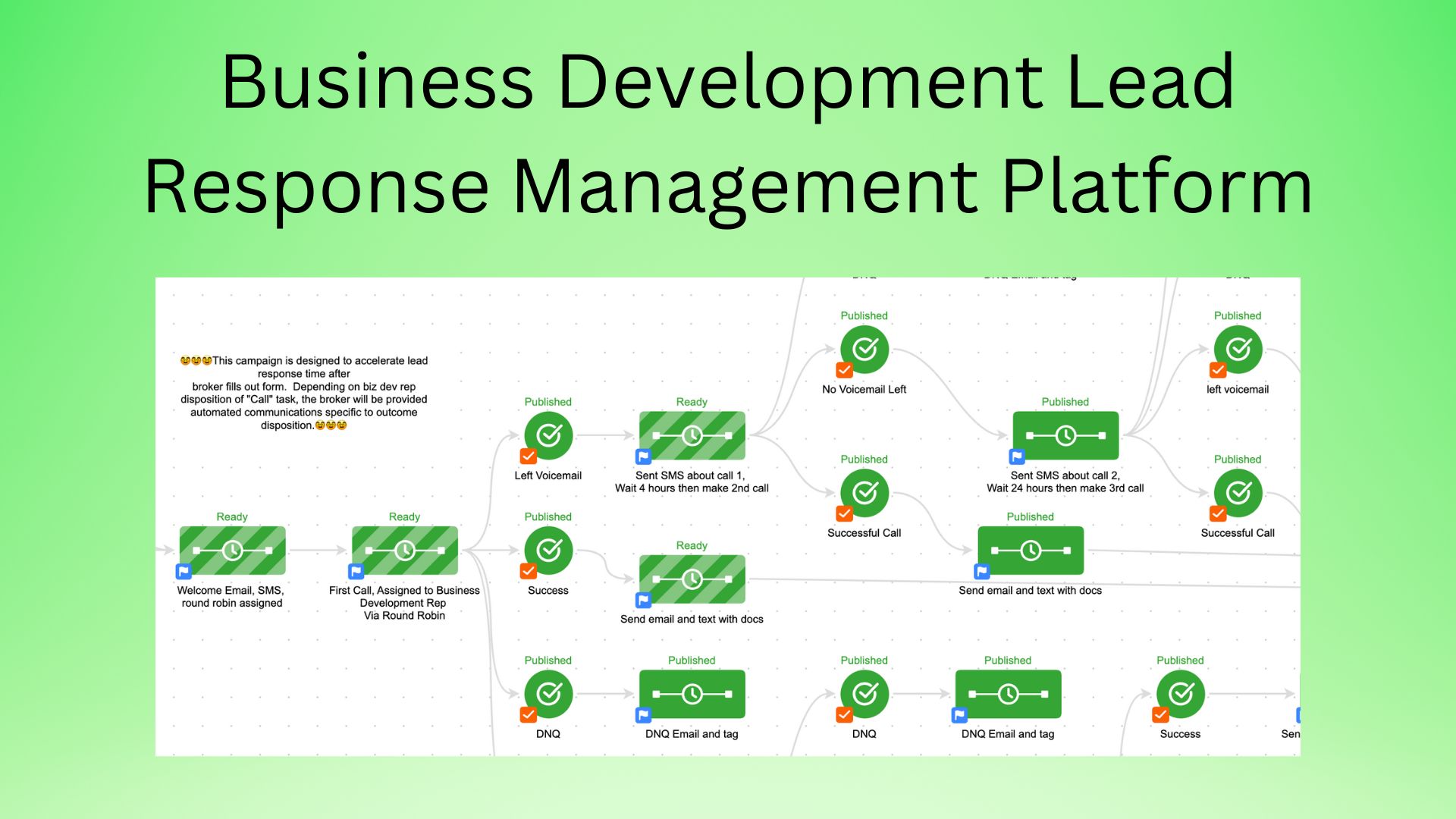

The above diagram provides a snapshot of how FinServe provides automation and accountability for your Business Development Rep’s response management to FinServe ISOs who’ve filled out a form to partner with your organization. Because this is provided within the marketing automation program, which we implement, reporting will help you keep your fingers on the pulse of each rep and their productivity onboarding their ISO leads. All of this while automating your rep’s onboarding emails, SMS/Text communications throughout the onboarding process.

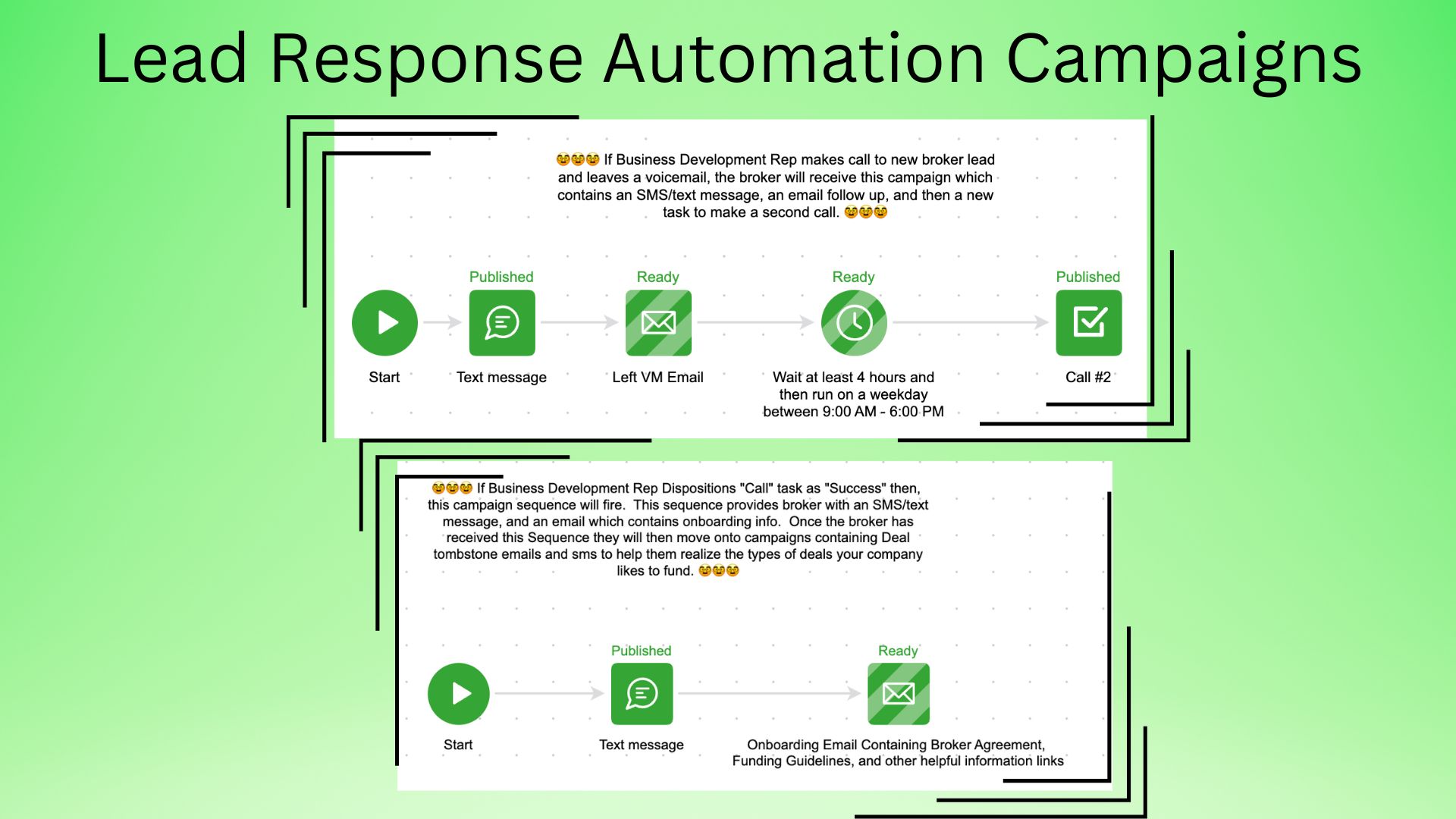

As you can see, the above image shows what automation takes place once a broker has been dispositioned with a successful onboarding call, or if a voicemail was left. FinServe builds behavior based campaigns designed to remove administrative human capital, providing your business development reps with resources to minimize their time in follow up and providing your guidelines and ISO agreement to only ISOs who the rep declares a good fit for your programs.

How FinServe’s Business Acceleration programs work:

1. FinServe Inbound Lead Generation –

FinServe builds (over 200 campaigns) implements campaigns for recommend lender, ISOs sign up with recommended lender through landing page links found in various marketing campaigns including;

- FinServe referral marketing emails and SMS/Text,

- lender brand emails,

- social media, and

- SMS/Text

Once ISO fills out form, lending team and designated Business Development Rep are notified in real time through FinServe built Lead Response Management campaigns.

2. Lead Response Management System –

FinServe implements a lead response management system for recommended lenders and their business development reps. This program will help you keep business development reps accountable for the onboarding of FinServe Marketplace ISOs, (our lenders have onboarded 80%+ of the inbound ISOs). When reps disposition their call task, FinServe provides behavior campaigns which provide only relevant content based on the disposition of the calls.

Typical dispositions consist of:

- “Success” – reps disposition a call as “Success” when they’ve had a conversation with an ISO of interest who seems to be a good fit for your partnership program. This automatically sends out ISO agreement, guidelines, and any other materials you provide to the ISO.

- “Left VM” – reps disposition a call as “Left VM” when they’ve made a call to interested ISO and have left a voicemail. This allows automation through SMS and email to ISO regarding the voicemail. It also allows the “system” to create a follow up task to call the broker again, based on a prescribed lead response cadence. This prescribed time line is inspired by a Harvard Business Review and FinServe study in the Finance Industry.

- “No Answer” – reps disposition a call as “No Answer” when they’ve made a call to interested ISO and were unable to leave a voicemail. This allows automation through SMS and email to ISO regarding the call in which they were unable to leave a voicemail. It also allows the “system” to create a follow up task to call the ISO again, based on a prescribed lead response cadence.

- “DNQ” – reps disposition a call as “DNQ” when they’ve made a call to interested ISO, spoke with them, and decided they were not a good fit for the partner program. Once dispositioned as such, an email will be sent to notify candidate and then no further communications will occur to that ISO.

3. Training and Implementation –

Once implementation of Business Development Rep Lead Response management system is complete (generally within 14 days of beginning lender relationship), FinServe will provide training to your team. The adoption of this “system” is simple, seamless. Our objective is to provide the easiest system for your reps to navigate, they can do so in seconds and will save your reps hours of administrative work, sending automated communications to your reps prospective ISO partnership.

4. Data Reporting –

Once we have ISOs going through onboarding process “system”, we will be able to look at reporting to see which brokers have been successfully onboarded, which reps are producing successful onboarding and which ones may need additional training in the system. Generally, all reps are able to easily adopt our incredibly simple, easy system.

5. Experience –

FinServe has been in the inbound lead generation, marketing technology, and sales enablement industry since it’s inception. Steve Conner has been providing these type of systems in business acceleration programs through many venture capital opportunities since 2004. Steve Conner has been a salesforce.com partner and implementer since 2004, an Inside Sales partner and implementer since 2007, and a Keap/Infusionsoft implementor since 2014. FinServe has over 18,000 business finance brokers who’ve produced over $6B in originations for FinServe recommended lenders each year since 2020.

If your lending firm is capable of accelerating, placing more capital, FinServe MarketPlace may be a good fit!